Impact of Russia-Ukraine War on Indian Economy: An Analytical Study

DOI:

https://doi.org/10.53724/inspiration/v10n2.02Keywords:

Russia-Ukraine War, Indian Economy, Global Conflict, Crude Oil Prices, Inflation, Supply Chain Disruption, Trade Relations, Import and Export, Geopolitical Tensions, Foreign Direct Investment (FDI), Rupee DepreciationAbstract

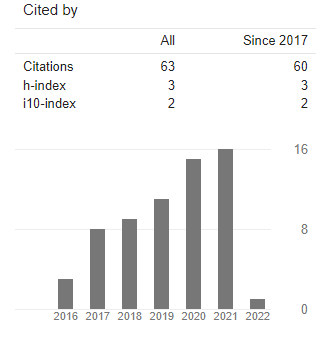

The outbreak of the Russia-Ukraine war in early 2022 marked a pivotal moment in contemporary geopolitics, triggering a cascade of economic disruptions that reverberated across global markets. As two of the world's leading exporters of essential commodities such as energy, wheat, and fertilizers, the ongoing conflict between Russia and Ukraine has severely strained global supply chains, increased market volatility, and heightened inflationary pressures worldwide. This capstone project provides a comprehensive analysis of the war’s economic repercussions on India—one of the fastest-growing emerging economies with deep strategic and economic ties to both Russia and the West. The study specifically focuses on four critical economic indicators: Foreign Institutional Investment (FII), Foreign Direct Investment (FDI), crude oil imports, and market returns, represented by the Nifty 50 index. By employing a combination of secondary data collection, statistical tools (such as SPSS-based paired t-tests), and in-depth literature review, the report evaluates the pre-war and post-war shifts in these variables from the year 2017 to 2024. Findings indicate that FII experienced only marginal change, with no statistically significant variation observed, suggesting investor caution or short-term neutrality in portfolio investments. Conversely, FDI recorded a substantial increase post-war, highlighting growing foreign confidence in India's long-term economic prospects, potentially driven by policy reforms and global diversification strategies. Crude oil imports from Russia surged significantly, as India capitalized on discounted prices amidst Western sanctions on Russia. However, this strategic shift raised critical concerns regarding India's energy security, geopolitical risks, and overdependence on a single supplier. Interestingly, market returns showed the most remarkable growth, with a statistically and practically significant post-war rise—indicating resilience in India’s capital markets, supported possibly by speculative inflows, domestic optimism, and favourable macroeconomic policies. Beyond the quantitative analysis, the report also delves into India’s diplomatic stance of strategic neutrality and explores its broader managerial and policy implications. It reflects on India’s evolving role in global geopolitics and its attempts to strike a balance between safeguarding economic interests and navigating complex international alignments. The study concludes by emphasizing the urgent need for energy diversification, trade route realignment, and the development of resilient domestic supply chains. It advocates for proactive policy frameworks that not only cushion the impact of external shocks but also enhance India’s preparedness in an increasingly uncertain and multipolar global economy.

References

R. Sharma and A. Mehta, “Economic impact of geopolitical conflicts on emerging markets,” Int. J. Econ. Policy, vol. 15, pp. 221-239, June 2022.

P. Verma, “The Russia-Ukraine war: Global supply chain disruptions,” J. Global Trade, vol. 8, pp. 112-130, April 2023.

S. Mukherjee, “Crude oil price volatility and its effects on Indian markets,” Energy Econ. Rev., vol. 11, pp. 78-94, May 2021.

A. Banerjee and T. Singh, “Foreign institutional investments during geopolitical crises,” Emerging Markets J., vol. 9, pp. 310-328, August 2022.

N. Kapoor, “Sanctions on Russia and their impact on global commodity markets,” Econ. Policy J., vol. 12, pp. 199-214, September 2022.

M. Roy, “The role of FDI in economic resilience during global conflicts,” J. Int. Finance, vol. 14, pp. 56-72, July 2021.

S. Bhattacharya, “Inflationary trends in India post-Russia-Ukraine conflict,” Indian Econ. Rev., vol. 10, pp. 341-358, October 2023.

T. Choudhury, “Impact of geopolitical instability on stock market performance,” J. Financial Analysis, vol. 17, pp. 129-144, March 2023.

R. Jain, “India’s energy security amidst Russia-Ukraine war,” Energy Policy Rev., vol. 19, pp. 215-230, December 2022.

V. Srivastava, “Trade disruptions due to war: A case of India,” J. Trade Policy, vol. 6, pp. 101-118, January 2023.

M. Kitamura and R. Noyori in “Ruthenium in Organic Synthesis” (Ed.: S.-I. Murahashi), Wiley-VCH, Weinheim, 2004, pp. 3–52.

D. Patil, “The long-term effects of war on developing economies,” Dev. Econ. J., vol. 5, pp. 88-102, July 2022.

G. Sinha, “How geopolitical risks affect currency exchange rates,” Forex Econ. Stud., vol. 7, pp. 45-62, June 2023.

K. Das, “Impact of Western sanctions on Indian imports and exports,” J. Trade & Finance, vol. 13, pp. 277-290, February 2023.

P. Mishra, “Economic uncertainty and investor sentiment in India,” Behavioral Finance J., vol. 10, pp. 115-130, August 2022.

S. Gupta, “India’s food security and global wheat supply chains,” J. Agri. Econ., vol. 9, pp. 67-84, May 2023.

B. Bose, “A study on economic sanctions and their effectiveness,” J. Int. Relations, vol. 5, pp. 231-246, November 2022.

A. Reddy, “The effects of war-induced financial crises on Indian banks,” Banking & Finance Rev., vol. 8, pp. 145-160, October 2022.

CDSL India, "Central Depository Services (India) Limited," [Online]. Available: https://www.cdslindia.com/. [Accessed: 04-Feb.-2025].

DPIIT, "Department for Promotion of Industry and Internal Trade," [Online]. Available: https://dpiit.gov.in/. [Accessed: 04-Feb.-2025].

PPAC, "Petroleum Planning & Analysis Cell," [Online]. Available: https://ppac.gov.in/. [Accessed: 04-Feb.-2025]

OGD, "Open Government Data Platform India," [Online]. Available: https://data.gov.in/. [Accessed: 04-Feb.-2025].

NSE, "National Stock Exchange of India Ltd," [Online]. Available: https://www.nseindia.com/. [Accessed: 04-Feb.-2025].

https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023; Dated- 10/02/2023.

Downloads

Published

How to Cite

Issue

Section

ARK

License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.